In the first half of 2023, the pet food market in Eastern Europe experienced an extraordinary surge in retail prices.

In Poland, for example, the average cost of pet food in March 2023 jumped by almost 43% compared to the previous year, according to a study by the think tank UCE research and the WSB Merito University.

A similar trend was observed in other regional markets. In Hungary, the average price of pet food will increase by 50% in early 2023 compared to the previous year the Federation of Hungarian Food Industries estimated in January. The federation has expressed concerns that with the unraveling cost-of-living crisis, consumer demand may be at risk.

These fears, however, did not materialize. The market turmoil dissipated as inflationary pressure eased further in the second half of 2023.

“The cost of living crisis has had little impact on pet care sales,” commented Aleksandras Bacevicius, research analyst at Euromonitor International.

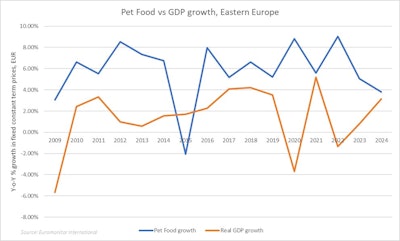

“Historically, the pet care industry has proven to be more recession-proof than other FMCG industries,” Bacevicius added. “It has recorded growth in past periods of economic hardship, such as during the Great Financial Crisis and the COVID-19 pandemic.”

Over the past decade, pet food prices in Eastern Europe have always outpaced average GDP growth, except for 2015, but pet food sales have continued to grow during this period.

Rising spending

Overall, the pet care market in Eastern Europe added 5% in value by 2023 in constant unit price terms, with not only essential pet foods but products such as cat and dog treats and mixers are thriving, Bacevicius reported.

Overall, spending per pet in Eastern Europe continues to increase in 2023, with the average dog or cat owner spending around EUR$108 (US$118) annually, a 3% increase increase from last year, in constant unit price terms.

“The amount consumed by dogs and cats continues to grow, proving that more spending is not only an effect of inflation, but also better calorific coverage,” said Bacevicius.

The dog and cat population in Eastern Europe shows a positive dynamic in 2023, recovering from a negative 1% growth in 2022, mainly due to a sharp decrease in Ukraine’s pet indicators. Poland outpaces the average for the region, growing at 1.4% in 2023.

Ukraine, Slovakia, Romania and the Czech Republic are experiencing declines in dog and cat populations. By 2024, the dog and cat population in Eastern Europe is expected to continue to show a marginal growth rate.

The move towards premium products continues to be one of the key trends in the market, with premium dog and cat food growing by 6% in 2022 in constant unit price terms, according to Euromonitor International.

“However, the cost-of-living crisis effect on the industry is not absent,” said Bacevicius. “Some pet owners are turning to cheaper private label offerings, with private label dog and cat food value components growing faster than the rate of inflation, at 15% in current price terms in 2022.

“In 2023, the economy and premium price segments are growing faster than the pet food median price, both in value and volume, indicating a slight polarization of the price segment,” he added.

Bacevicius believes that 2024 is expected to be another growth year for pet care in Eastern Europe, with both value and volume growing at a more modest 4% and 3%, respectively.

Exports are the backbone of an industry

In the past two years, Eastern Europe has strengthened its position as an export region, largely thanks to Poland, which will become the fifth largest exporter of pet food in the world by 2022, research conducted by the Polish Economic Institute.

Pet food is one of the most important goods in Poland’s exports. In 2022, export sales will reach EUR$1.9 billion (US$2 billion), equivalent to 4% of Polish agrifood exports.

In the last decade, the export of pet food in Poland increased by 461 in financial terms and 180% in physical terms. Poland accounts for 4.6% of global pet food exports, the Polish Economic Institute estimates.

Poland exports pet food mainly to other EU countries, with 34% of all deliveries going to Germany, 5.4% to Italy and 5.3% to France and the Czech Republic.

Last year, analysts said the numbers were poised for further growth, especially thanks to the opening of the Chinese market for the Polish pet food industry in June 2023.