Founded in 2011, Chewy (NYSE: CHWY) embarked on an almost impossible task: Battle the world’s retail and e-commerce giants to create a niche market for pet owners. I believe it’s safe to say that the company has officially succeeded against incredibly long odds.

Chewy will report finalized financial results for 2023 on March 20, so investors don’t know the final numbers yet. But the company is on pace to report about $11 billion in full-year net sales by 2023 — and nearly three-quarters of those sales will be for consumable products like pet food. Therefore, it has clearly taken market share from entrenched incumbents over the past decade.

Chewy is taking market share in the pet industry for a variety of reasons. First, pet owners are increasingly shopping online — this secular trend is driving sales growth. Second, this e-commerce platform offers automatic shipments on a schedule. And its customers seem to appreciate this feature, considering 75% of sales are from autoship customers. Third, it prides itself on customer service, which helps it stand out from the crowd.

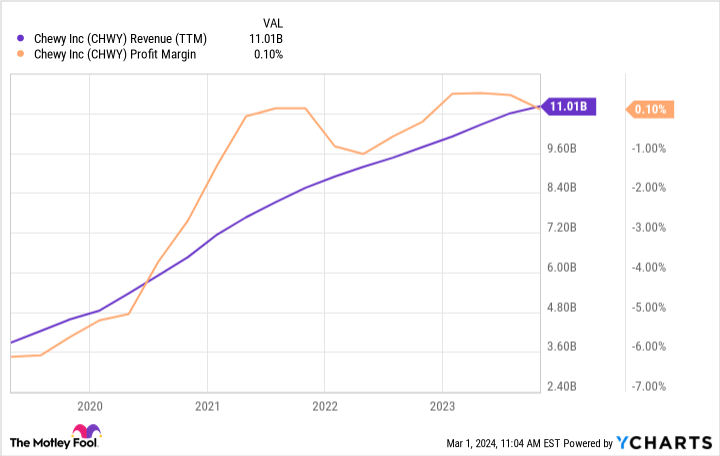

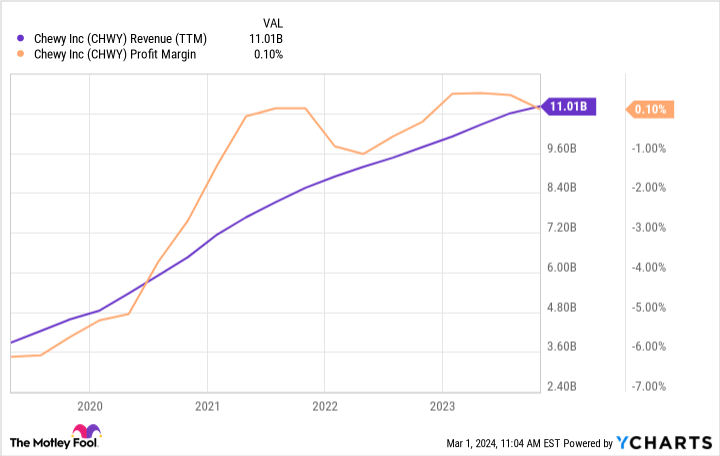

Most impressive for Chewy, however, is how profitable the company has become. The pet-food business is highly competitive, and profit margins are consequently thin. Moreover, being a dedicated e-commerce platform comes with high costs for shipping and logistics.

However, Chewy opened its first automated distribution center in 2020 and has since opened several more. The importance of its investment in automation cannot be overstated.

The chart shows that the company’s profit margins have improved dramatically since it flipped the automation switch.

Chewy is a large, profitable e-commerce platform for pet owners. And this is a big part of the investment thesis for this stock. However, many investors may not know that it has only begun to address an $11.5 billion market that is different. And it may hold the keys to the future of this business.

Chewy: the software company?

For years, Chewy’s management has talked about the pet health opportunity but from a business-to-buyer perspective The platform already offers health solutions such as educational content, prescription drugs, telehealth services, and insurance.

But now, Chewy focuses on pet health from a business-to-business perspective Its target customer here is the estimated 30,000 veterinary clinics nationwide.

At its investor day presentation in December, Chewy’s management said it was launching an operating-system software for vets called Rhapsody. This cloud-based software allows vets to manage their businesses with features such as scheduling, messaging, expense tracking, task management, and more.

Additionally, Chewy offers another software solution called Practice Hub. It integrates with Rhapsody or other management software so veterinarians can provide patients with the products they need. Simply put, Practice Hub is simply an e-commerce portal for veterinarians so they don’t have to hold excess inventory in their clinics. They can simply order for what they need in Chewy through their existing management software.

The benefits of Chewy’s move to software are readily apparent. This expands the company’s addressable market by allowing it to focus on enterprise customers. And it could potentially boost its retail business as vets come on board.

The president of Chewy’s health division, Mita Malhotra, said the move allows the company to “unlock $11.5 billion in click product sales [total addressable market] that we are not participating in now and making us more strategic in our existing supply relationships.”

Why does this all matter?

In case anyone was wondering, when a company with $11 billion in sales opens up an $11.5 billion opportunity, like Chewy did, it’s a big deal. Growth from its software business could be significant if adoption takes off.

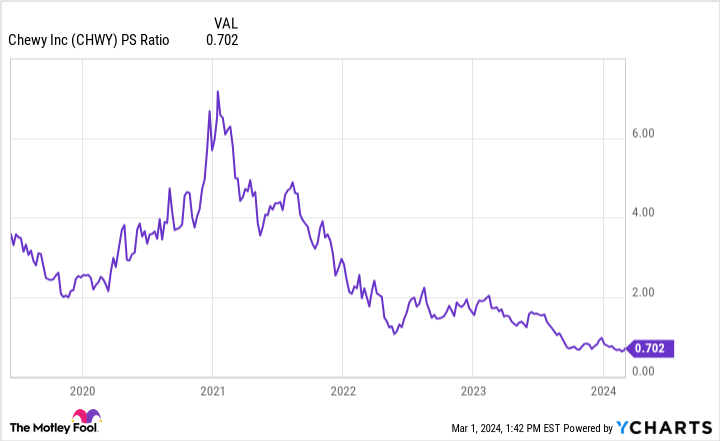

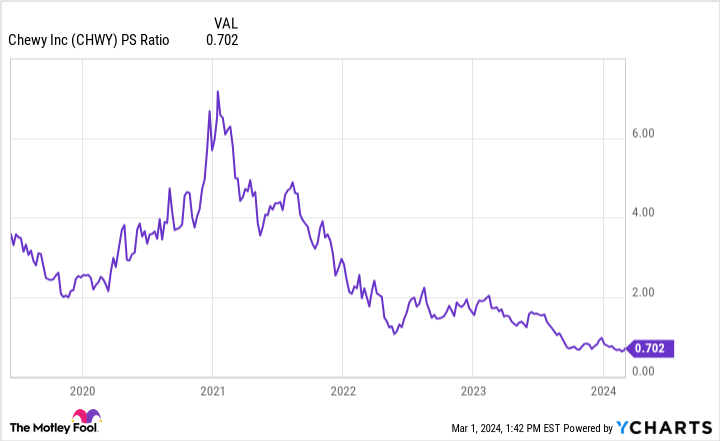

This is also a big deal for investors today. As of this writing, Chewy stock has fallen to an all-time low (cheap) valuation. The chart shows the trend for the price-to-sales (P/S) ratio valuation.

At this valuation, the market says Chewy will not grow, or it will fail to generate income for shareholders. The market may be saying the same thing. But as I said, Chewy’s software business could create a new recurring revenue stream, as well as catalyze growth for its e-commerce business.

Furthermore, growth for its e-commerce business could allow Chewy to grow its nascent digital advertising business, which is a high-margin opportunity.

The larger scale for its retail operations is good for Chewy’s profits, given its operational improvements from automation. And higher-margin opportunities like advertising and software can also boost the bottom line.

In summary, the market could be completely wrong about Chewy because of its new enterprise software business. And that could easily make it a market-beating stock if the company succeeds.

Should you invest $1,000 in Chewy right now?

Before you buy stock in Chewy, consider this:

The Motley Fool Stock Advisor The analyst team only recognized what they believed 10 best stocks for investors to buy now… and Chewy is not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor gives investors an easy-to-follow blueprint for success, including a portfolio construction guide, regular updates from analysts, and two new stock picks every month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

View 10 stocks

*Stock Advisor returns on February 26, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Chewy. The Motley Fool has a disclosure policy.

Everyone Knows Chewy Sells Pet Food and Toys. But The Company Has Started Addressing the $11.5 Billion Market You Might Not Expect. was originally published by The Motley Fool