You may also like:

Here are 7 important trends in the pet industry for 2024 and beyond.

The global pet industry is expected to reach $300 billion by 2030.

The question is: which trends will drive this growth?

From pet food to supplements, this list will help you see what’s coming up around the pet area.

1. Removing Pet Supplements

The pet supplement industry is set to reach $1.05 billion by 2027, according to analysis by Grand View Research.

Examples of trending pet supplements include dog vitamins, cat fish oil, and dog probiotics

But one particular area that is growing rapidly is pet probiotics.

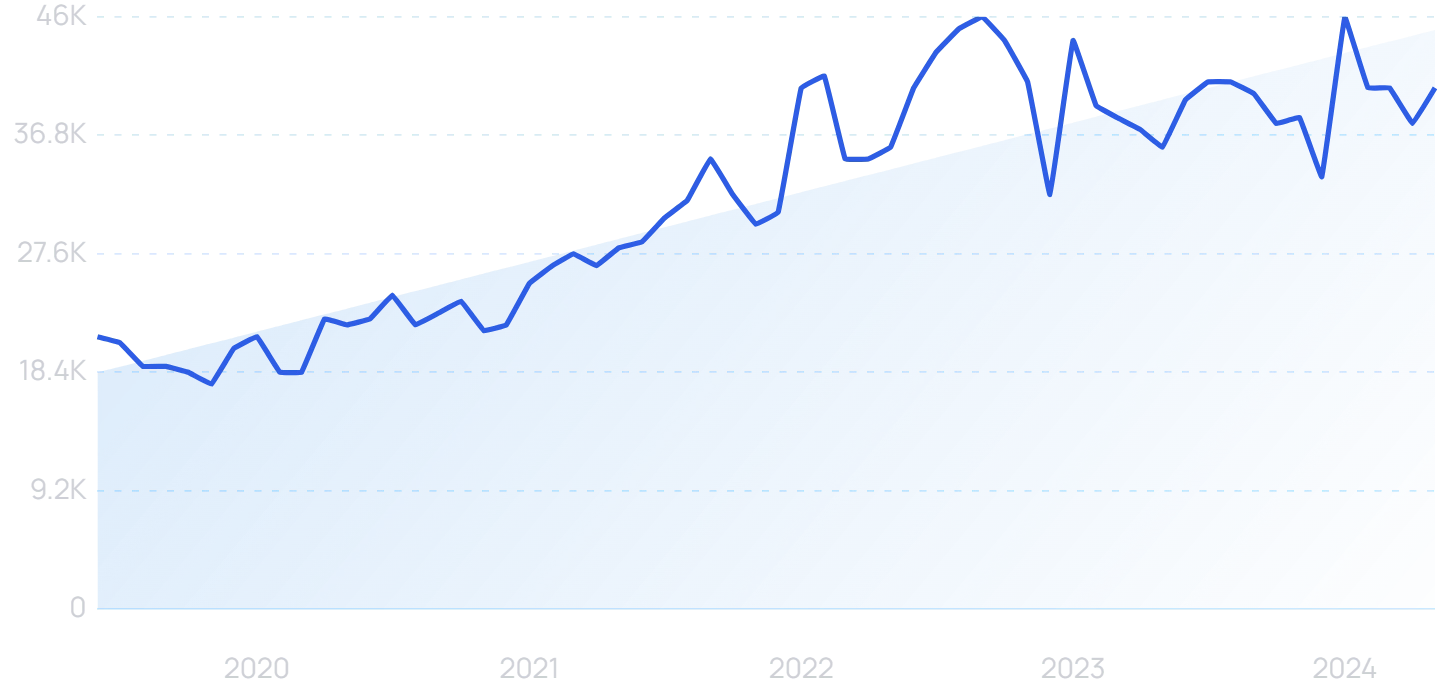

Searches for “dog probiotics” have increased 91% in the last 5 years.

Probiotic treats can help pets suffering from digestive issues and food allergies.

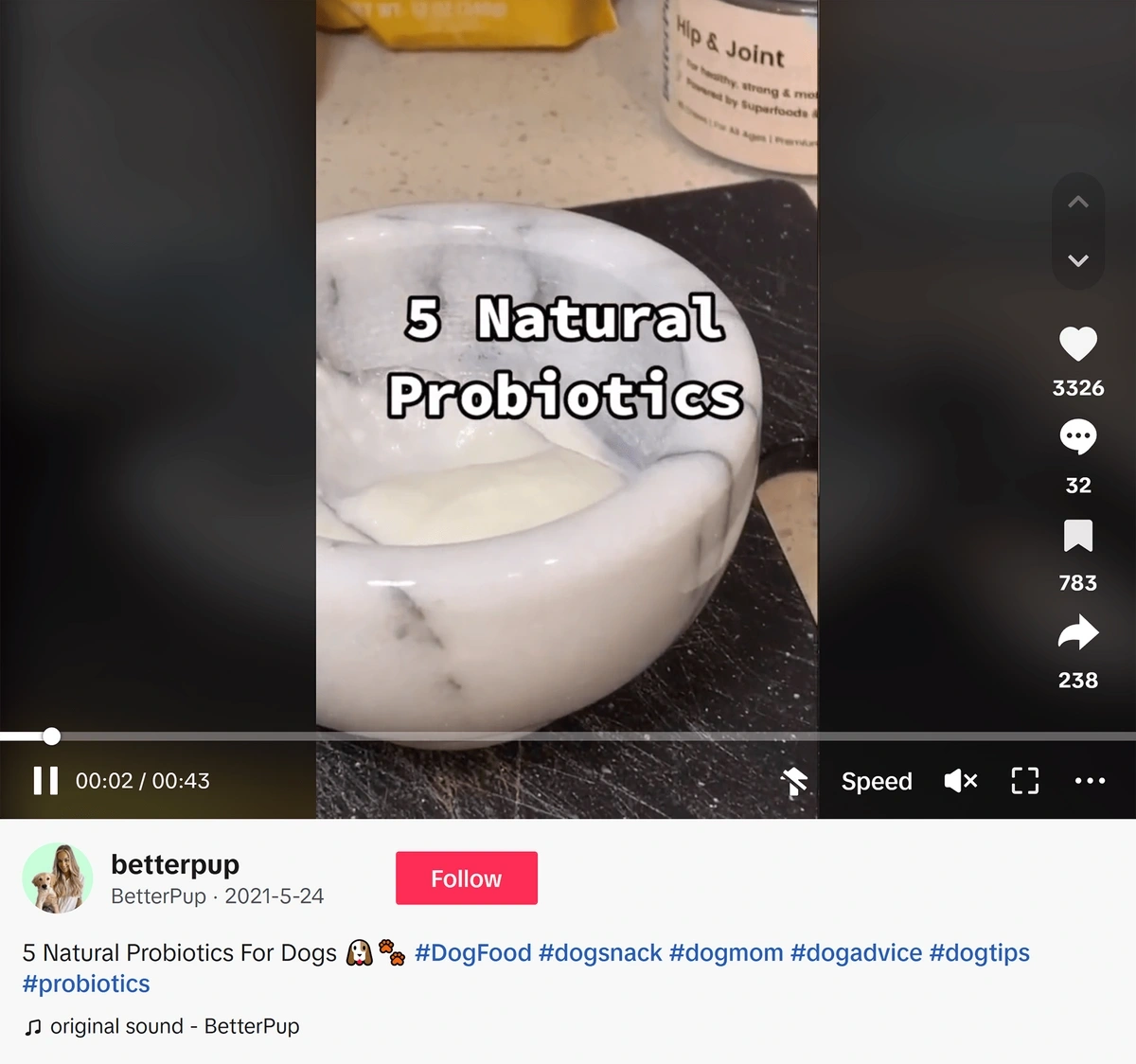

Probiotics for dogs and cats have also become popular on TikTok: videos mentioning the product have more than 386 million views on the platform.

This trend is heavily driven by the “humanization of pets”. This means that people are starting to feed their pets the same type of food that they eat themselves.

People are now paying more attention to their gut health (about 33% of people say they try to consume gut-friendly probiotics every day).

And these people are starting to add gut-supporting products to their pet’s diets.

In fact, about 7% of pet owners purchased a gut-supporting formula in the past year.

2. New Product Categories Appear

The pet industry traditionally consists of several product categories:

- Food

- Toys

- Beds

- Straps

- Cleanliness

- Pet grooming

But we are starting to see a significant amount of innovation in pet product R&D.

In particular, entrepreneurs do not simply launch variations of existing products.

They are creating entirely new pet care product categories.

For example pet wipes.

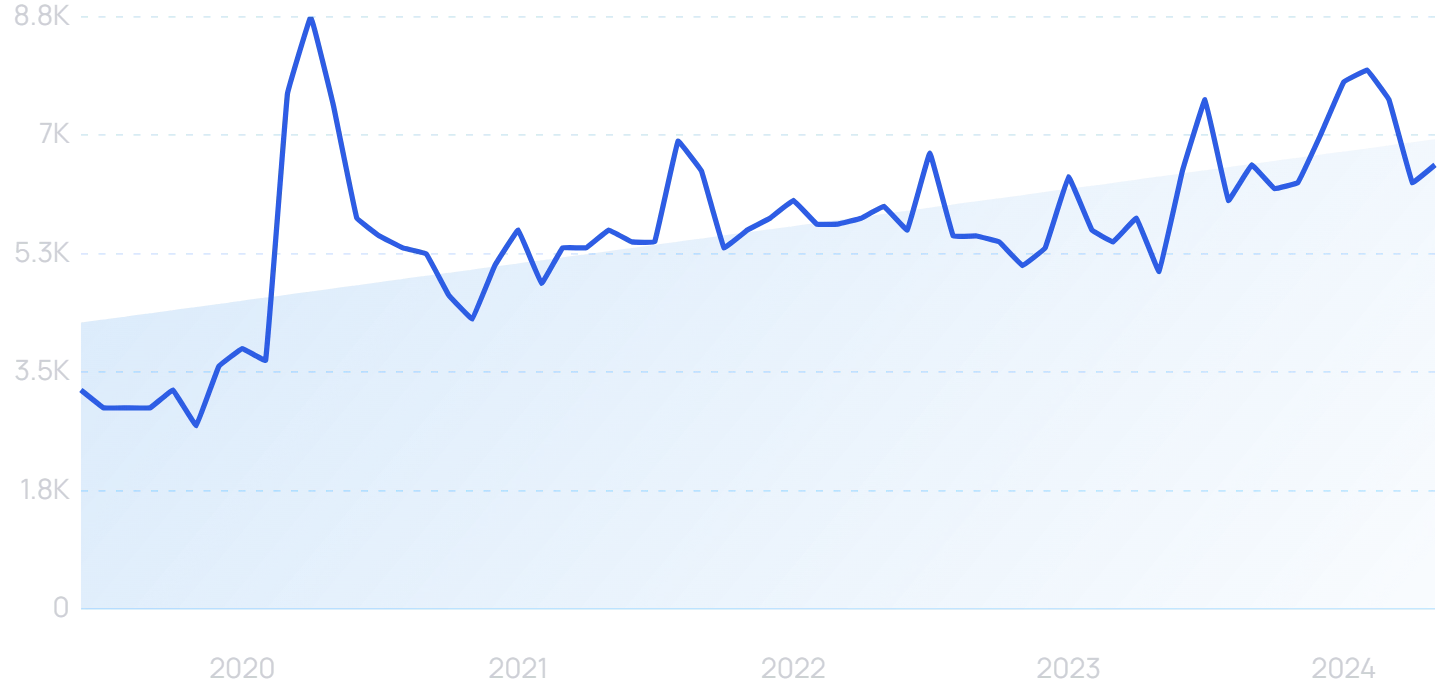

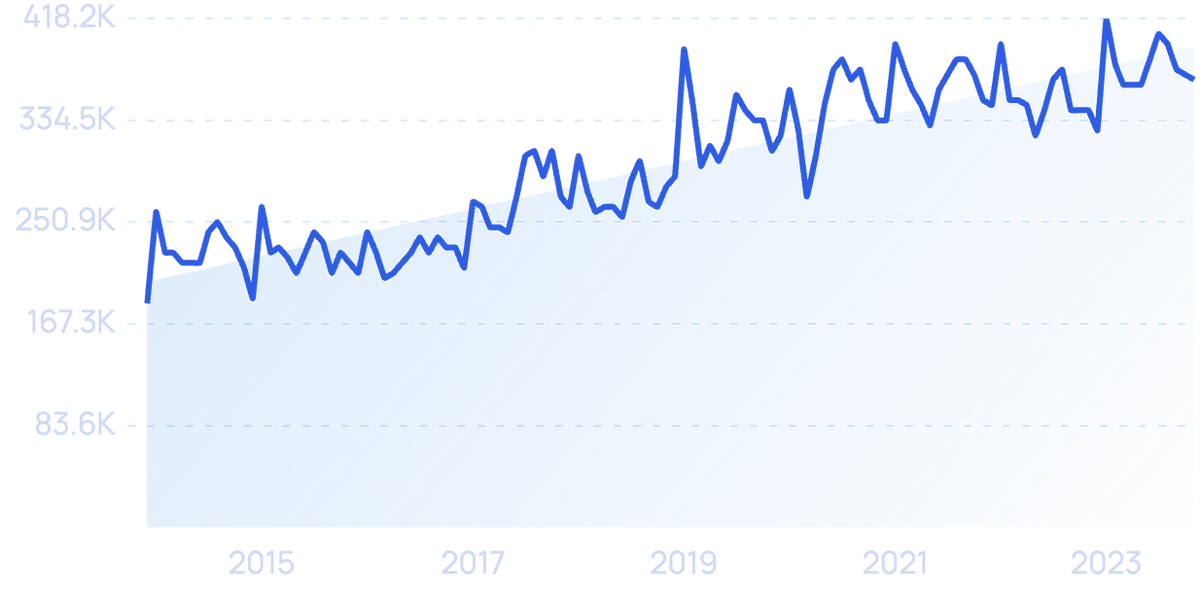

Searches for “pet wipes” have grown 103% in the past 5 years.

Pet wipes are essentially moist towels that are used on pets after going to the bathroom. Although a relatively new category, Amazon already has nearly 300 brands of pet wipes for sale.

Another growing pet product category is pet toothpaste.

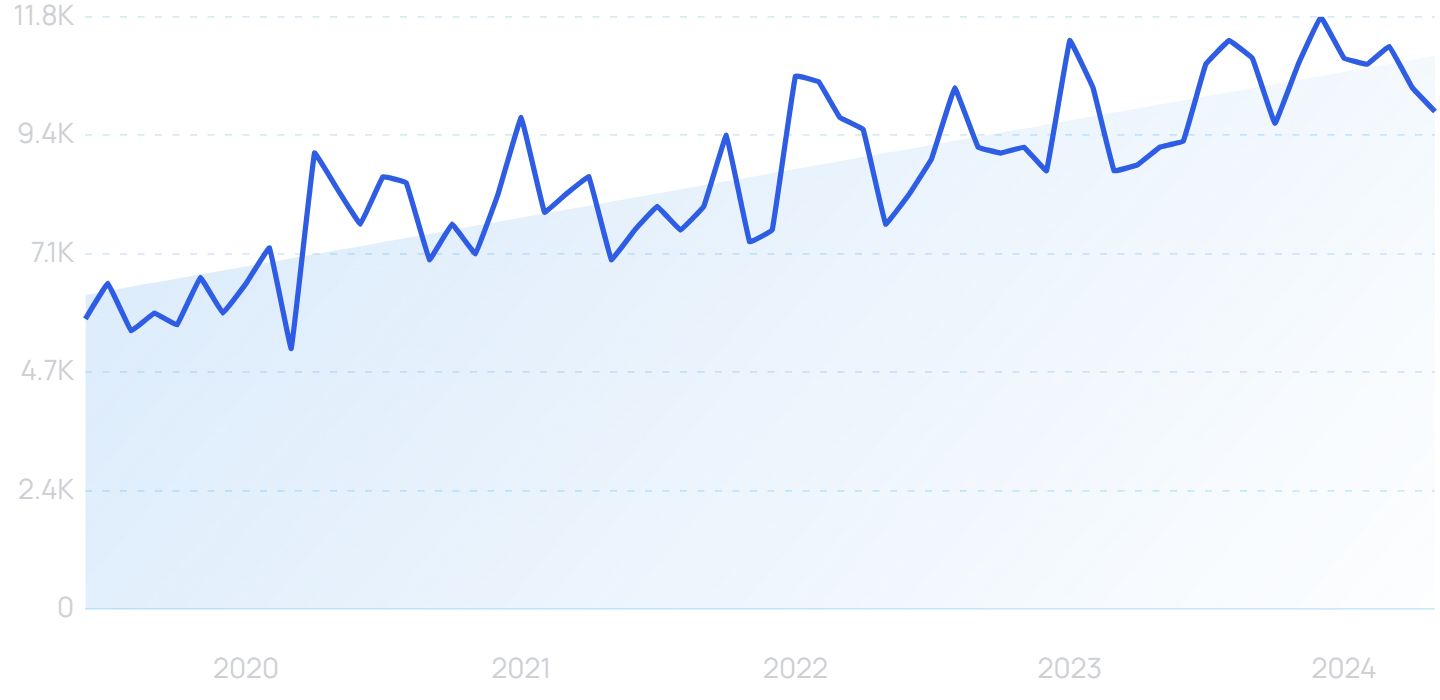

“Cat toothpaste” searches have increased 71% in 5 years.

Oral hygiene products for pets are not new. But new products (like cat toothpaste) are popping up for owners who want to make sure their pet’s teeth and gums are in tip-top shape.

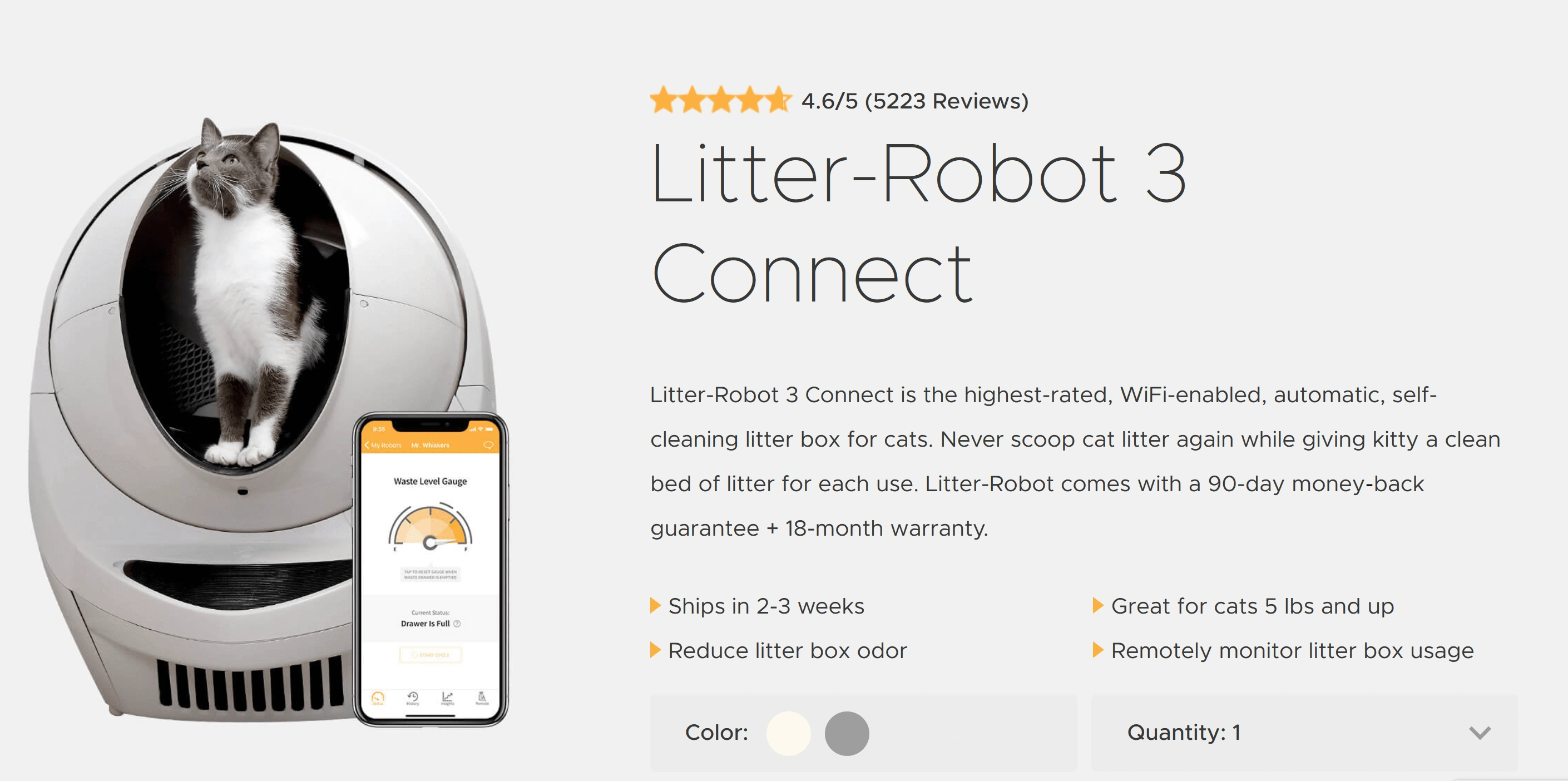

Litter-robot is another brand looking to create a new category in the pet industry.

Shot of Litter-Robot 3.

Litter-Robot sells a battery-powered, Wi-Fi-connected litterbox that cleans itself after each use. At $500 per unit, this product also taps into the pet industry trend we’ll talk about next: luxury pet products.

3. High-End Pet Products Go Mainstream

Whatever the product: if it makes their pets happy, there is a group of owners who will buy it.

And that includes relatively expensive luxury products.

For example, The Bear & The Rat, a startup that makes frozen yogurt for dogs is sold in Whole Foods stores nationwide. It competes with Nestlé’s Purina Frosty Paws.

Pretty Litter is probably the best example of a high-end pet product.

Pretty Litter is a brand of kitty litter that changes color based on the pH levels of cat urine.

The company, with branding that targets millennials and Gen Z consumers more, says the product helps cat owners detect diseases in their cats, such as worms, metabolic acidosis, or a UTI.

Pretty Litter is also notable because, unlike most other kitty litters on the market, their product is not available in pet stores or supermarkets.

Instead, they sell their product exclusively through a monthly subscription.

The Pretty Litter product works.

Cat kennels are another example of a luxury pet product on the rise.

Cat kennels are fenced areas designed to help cats spend time outside. While reducing the risk of escape or danger.

Searches on “Cat enclosure”. has grown steadily (by 79%) over the past 10 years.

Some cat cages can cost upwards of a thousand dollars. That makes them part of the high-end pet product trend.

4. Increasing Number of Pet Food Niches

According to Pet Biz Marketer, pet food makes up about 3/4s of all sales in the pet industry.

We’ve noticed pet food brands gaining market share through niche pet foods.

And startups aiming to gain traction in the space by launching entirely new types of pet food.

One of the fastest growing niche pet food categories right now is freeze-dried dog food.

Search growth for “freeze dried dog food” has increased 79% over the past half decade.

Freeze-dried dog food is just what it sounds like: it’s dog food that’s freeze-dried to extend its shelf life.

Top-down view of freeze-dried dog food.

And many freeze-dried dog food brands (like Bixbi), contain raw food ingredients, like organ meats and vegetables.

These ingredients are difficult to package and ship in pet food form. Hence the rise of freeze-dried pet food.

PetFoodIndustry.com reports that sales for “non-traditional pet food formats” (such as freeze-dried) are growing faster than traditional pet food.

Raw dog food is another growing pet food niche.

According to a survey conducted by the University of Guelph Ontario Veterinary College, 66% of dog owners and 53% of cat owners feed their pets raw food.

This trend can be seen in the search trend data.

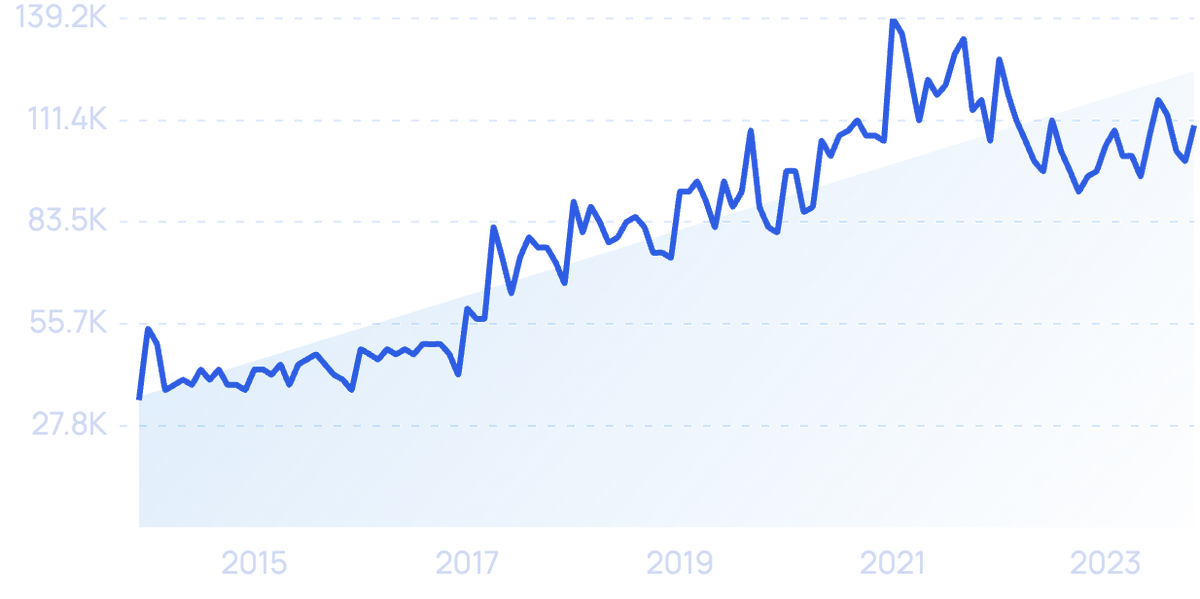

Google searches for “raw dog food” have increased 216% in 10 years.

5. Pet Owners Are Increasingly Opting For DTC

Like ecommerce in general, pet owners are turning to online retailers for selection, convenience, and price.

One of the leaders in the pet DTC space is pet supply ecommerce brand Chewy.com.

Chewy’s reported 2021 revenue is $10 billion, a 12% increase over last year..

Amazon is also looking to tap into the pet DTC product trend.

Screenshot from Amazon’s popular “pet supplies” category.

In fact, Amazon already sells a reported $3.6 billion annually in pet food alone.

6. The Pet Insurance Space Continues to Grow

Pet insurance is one of the most interesting trends in the pet industry in 2024.

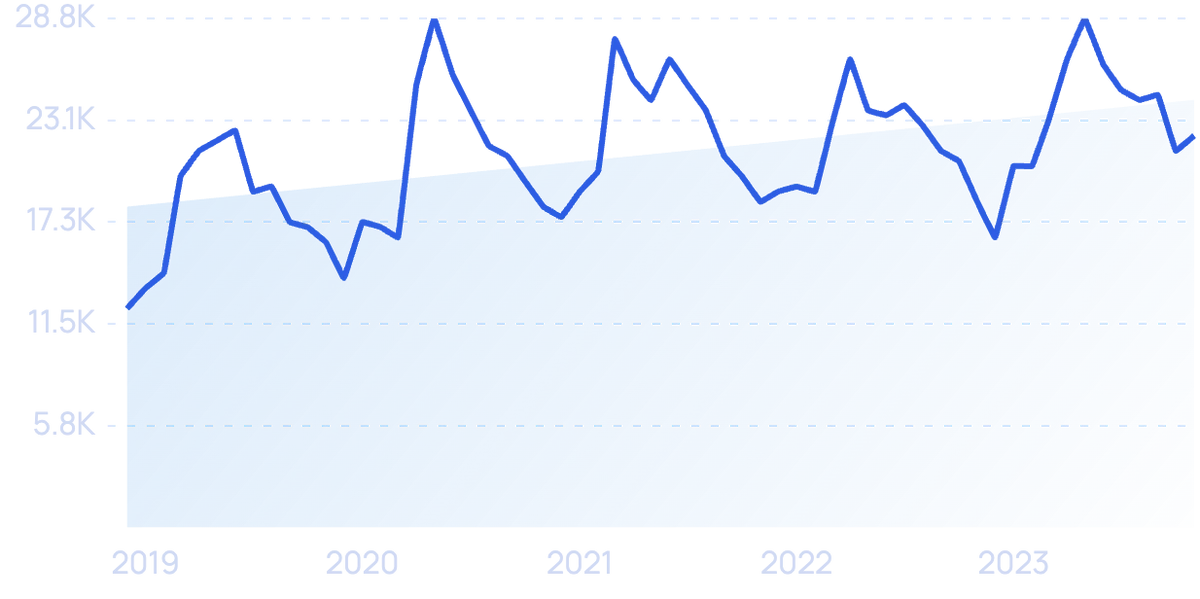

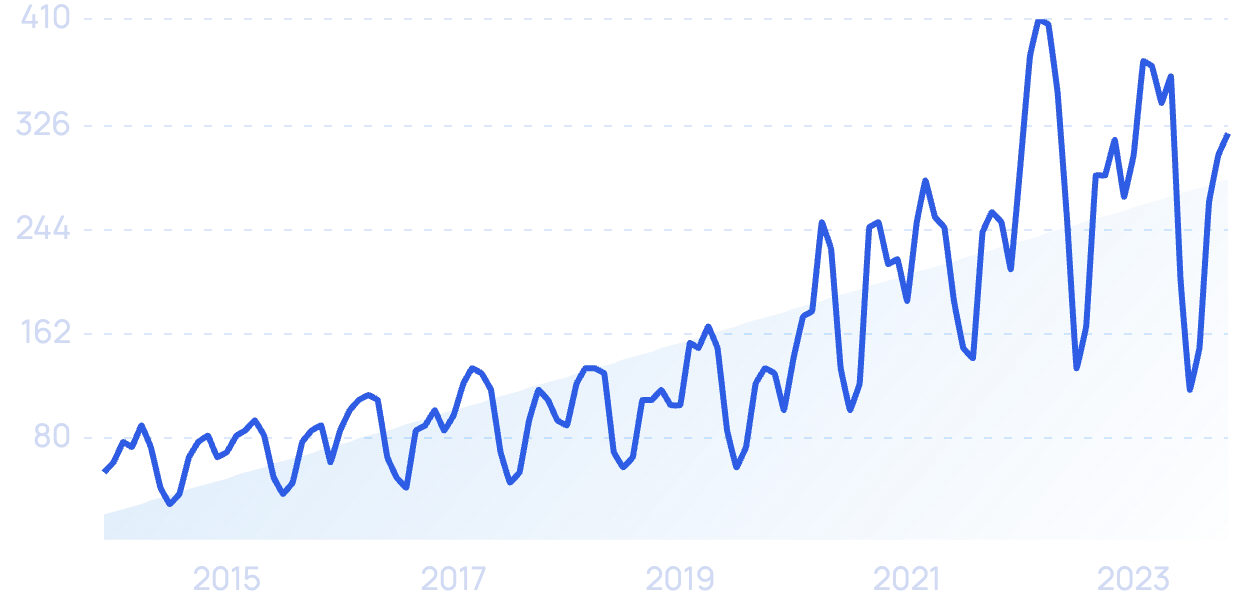

Searches for “pet insurance” have been slowly but steadily growing at 100% over the past 10 years.

Globally, the pet insurance industry will reach $9.4 billion in 2022 and is expected to grow at a compound annual growth rate of 17.04% through 2030.

This explains why AI-powered insurer Lemonade launched its own pet insurance range in 2020.

Lemonade is entering the growing pet insurance space.

Pet-focused competitors in the space include Healthy Paws, GoPetPlan, and the non-profit ASPCA.

7. Pet Owners Prefer Natural Food Brands

A survey of 2,181 pet owners found that 43.6% prioritize the health of their pet’s food over their own.

One brand that is bucking this trend is Because Animals.

Looking for a natural pet food and supplement brand Because Animals has grown 500% in 10 years.

Because Animals specializes in healthy pet food.

Especially focusing on factors that human owners tend to look for in their own food, such as organic ingredients and omega-3 content.

Other growing natural pet food brands include Open Farm and Lily’s Kitchen.

Conclusion

That’s it for our list of important trends affecting the pet space.

The one thread that binds almost all of these trends is: pet health and wellness.

It is clear that “pet parents” are increasingly concerned about the health of their pets. And that they are willing to spend money to maximize the health of their furry friends.

As pet ownership continues to increase, we can expect the industry to grow with it.